It is going to depend upon the conditions. A lot of people find themselves economically insecure after depending on credit cards to help make finishes meet up with on a monthly basis. If this matches your circumstance, you probable maxed out your credit limitations prolonged before thinking about filing for individual bankruptcy and possibly will not likely operate into a problem.

Although a presumptive fraud circumstance is simpler to get, a creditor who wants to Get better prices produced a lot more than 90 days before bankruptcy can file a standard fraud circumstance.

Because financial debt consolidation loans commonly have lessen curiosity fees than credit cards, They are really a less expensive solution to repay substantial-curiosity credit card balances.

Normally, it is best not to make use of the credit card that you just system on together with in the bankruptcy If you would like your case to go as smoothly as feasible. On the other hand, it is understandable that you may have to use your card for vital or needed purchases, for instance to purchase groceries, fuel, or lease.

Even so, your potential wages should still be vulnerable to undischarged personal debt, like again baby help or earnings committed in a payment plan for Chapter thirteen.

Get debt reduction now. We've assisted 205 clients find Lawyers now. There was a problem with the submission. Be sure to refresh the webpage and check out once more

A credit counselor can help Consider your latest monetary predicament and ascertain whether bankruptcy is click to find out more the best program of action.

Nevertheless, you will not wish to deliberately max out credit cards devoid of intending to pay out the bill—for example after determining to file for bankruptcy. If the fees Never qualify for your necessity exception, your creditor weblink could view your motion of maxing out your cards to be a fraudulent act.

If it finds evidence of fraudulent action, it could file a lawsuit versus you as part of your individual bankruptcy, identified as an adversary proceeding, inquiring the court docket to generate that debt nondischargeable.

It is even less difficult for the creditor to show fraud once you charge merchandise during the ninety times before the personal bankruptcy filing. So, it's best to stop charging on credit cards whenever you understand you can't pay back your debts or ninety times Homepage before you file, whichever takes place quicker.

Credit cards and banking specialist Jenn Underwood delivers over sixteen many years of private finance expertise into the table. After ten years of educating classes in banking, financial debt reduction, budgeting and credit advancement, she moved into creating information and fintech product progress.

With any luck ,, you have the promise to remove the account in creating in order to post it with all your dispute whenever you transfer to suitable your credit.

You'll find various sorts of property this contact form finance loan loans, each with its positives and negatives. Typical loans, FHA financial loans and VA loans are prevalent possibilities. Research each variety to pick which best fits your economical predicament and lengthy-expression objectives.

" You should use a "Chapter 20 personal bankruptcy" to cope with debts not discharged by way of your Chapter seven personal bankruptcy. The Chapter 13 repayment prepare will click to read give you a chance to pay off All those debts about 3 or five years With all the safety in the bankruptcy court docket.

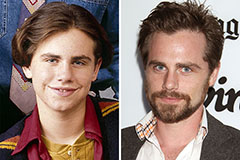

Rider Strong Then & Now!

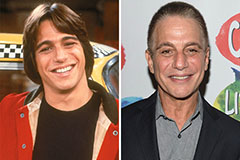

Rider Strong Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!